In 2009 the Government of Canada introduced the Tax-Free Savings Account (TFSA) allowing Canadians to invest a maximum of $5,000 annually. The TFSA initially was confusing for some account holders, partly due to its name which basically sounded like a bank savings account. Many customers were opening TFSA savings accounts at their banks and earning very low interest rates of growth. Over time, it became more widely know that the TFSA account was not limited to what products could be invested inside of it, rather it was a vehicle to save and invest tax-free.

In 2015 the maximum annual contribution was raised to $10,000 (following $5,500 limits in 2013 and 2014) and in 2016 the max contribution went back to $5,500. The annual limit is now $6,000 and as of 2021, the cumulative total of TFSA contribution room is $75,500 for Canadians inside their TFSA accounts. The TFSA has been often compared to an RRSP in terms of which one is better to invest in. The truth is that both accounts can be complementary to one another in planning for retirement income. Contact me today to learn more about how these accounts could benefit your own financial situation.

Consider the following scenarios based on annual income:

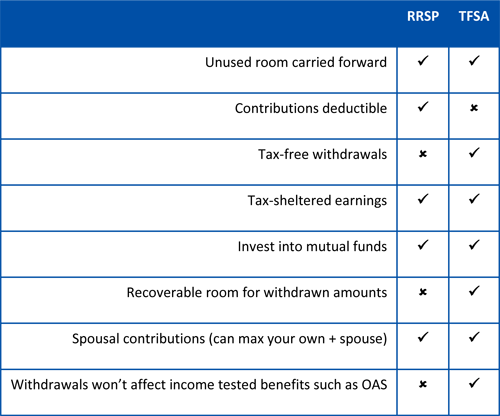

RRSP vs. TFSA

It comes down to how much you make now and how much you expect to make in retirement. The secret is to keep your marginal tax rate as low as possible—now and later.*

If you earn less than $30,000, your tax rate is already low, so the RRSP isn't a huge tax benefit. With a TFSA, you're contributing after-tax dollars, but won't have to pay again when you withdraw your money later.

If you earn $30,000–$80,000, both may be equally useful, depending on your current and future marginal tax rates. If your income's higher now than you expect it to be at retirement, consider an RRSP. If not, a TFSA might be better.

If you earn $80,000+, take advantage of both. Consider using your annual RRSP tax deduction to fund your TFSA.

* c/o Saver's Choice: Comparing the Marginal Effective Tax Burdens on RRSPs and TFSAs, C.D. Howe Institute, 2010

This comparison chart helps identify some of the features and differences of the TFSA and RRSP accounts: